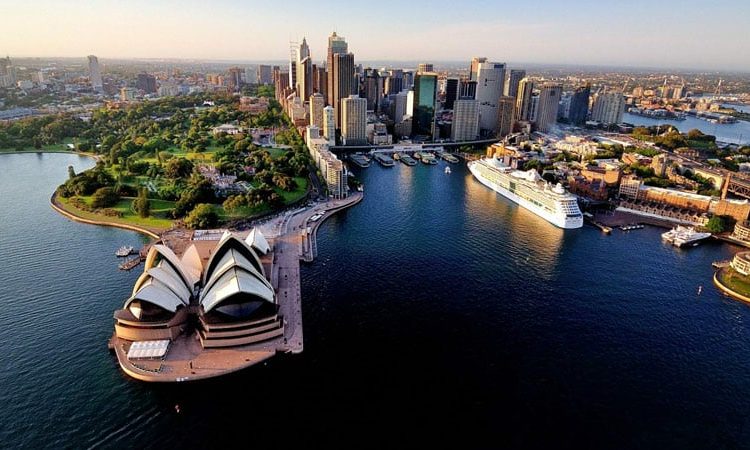

Golden Migration: Why Chinese Investors Are Betting Big on Australian Real Estate

A New Gold Rush Down Under

The latest figures are in, and they paint a clear picture—Chinese investors have firmly established themselves as the dominant foreign force in Australia’s residential real estate market. With a staggering A$2.6 billion invested in the financial year ending June, their appetite for prime property is not just growing—it’s evolving. But why now? And why Australia?

The Lunar New Year Surge: A Sign of Things to Come?

If the first five days of the Lunar New Year are any indication, 2024 is shaping up to be a record-breaking year for Chinese investment in Australian housing. Peter Li, general manager of Plus Agency in Sydney, noted a 20% spike in inquiries during the holiday period, with buyers targeting larger, more expensive homes. In just five days, his agency secured 12 deposits, signaling an unmistakable shift towards high-end property acquisitions.

The Billionaire Mindset: From Duplexes to Mansions

This isn’t just about volume—it’s about scale. Chinese investors, who once set their sights on mid-range properties, are now doubling down on luxury estates. Take the case of one mainland Chinese family, who originally planned to buy a A$3.5 million duplex in Chatswood. By the time the deal closed, they had upped their budget to A$5 million and purchased a five-bedroom mansion instead. It’s not just a home—it’s an investment in legacy.

The Driving Forces: Family, Familiarity, and Financial Safety

What’s fueling this property boom? According to Li, three key factors are at play:

- Cultural & Family Ties: Australia’s Chinese diaspora is one of the largest in the world, with over 600,000 China-born residents as of 2022. Many investors are purchasing homes not just as assets, but as future residences for extended family members.

- Safe Haven Investing: With economic turbulence and geopolitical uncertainty casting long shadows over China, wealthy investors are looking to Australia as a financial refuge. Unlike volatile markets in the US and UK, Australia offers a stable economic climate, low crime rates, and predictable property appreciation.

- Geographical Convenience: Australia’s relative proximity to China and similar time zones make it a far more appealing option compared to distant Western markets.

The Numbers Speak: A Market Ripe for Growth

Beyond sentiment, the hard data supports a bullish outlook for Australian real estate:

- Australian house prices have nearly doubled in the past decade, reaching an average of A$986,000.

- Rental rates are at record highs, making property ownership an attractive income stream.

- The Reserve Bank of Australia is expected to cut interest rates, further stimulating demand.

- Sydney’s prime real estate is projected to grow by 6% in 2024, with continued price hikes through 2025.

The Luxury Supply Squeeze

Sydney’s luxury property market is facing a significant supply crunch. Unlike Dubai, where rapid development fuels supply growth, Sydney’s shortage of prime properties is driving prices up. Kelcie Sellers, an associate director at Savills, predicts luxury home prices will rise by 4% to 5.9% in 2025, fueled by international and domestic demand.

A Word of Caution: The Affordability Ceiling

Not everyone is bullish. While Chinese investment is reshaping the market, Colliers warns that affordability constraints may slow price growth beyond 2025. After years of surging prices, many buyers—especially on the East Coast—are reaching their financial limits.

Conclusion: The Future of Chinese Investment in Australia

One thing is certain—Chinese investors are playing the long game. With a preference for stability, a growing affinity for high-end properties, and an eye on long-term capital appreciation, their impact on Australian real estate is only just beginning.

Will this influx of foreign capital push Australian housing to new heights? Or will affordability concerns cool the market? Either way, one thing is clear: the great migration of Chinese wealth to Australia is in full swing, and the ripple effects will be felt for years to come.